Senior (LSE:SNR) is a stock that doesn’t get a huge amount of attention. But after it fell 13% on Tuesday (8 October) investors might want to take a closer look at the FTSE 250 manufacturer.

While the company is facing some issues, management believes these are short-term in nature. And with the stock at a 52-week low, its shares might be available at an unusually good price.

What’s going on?

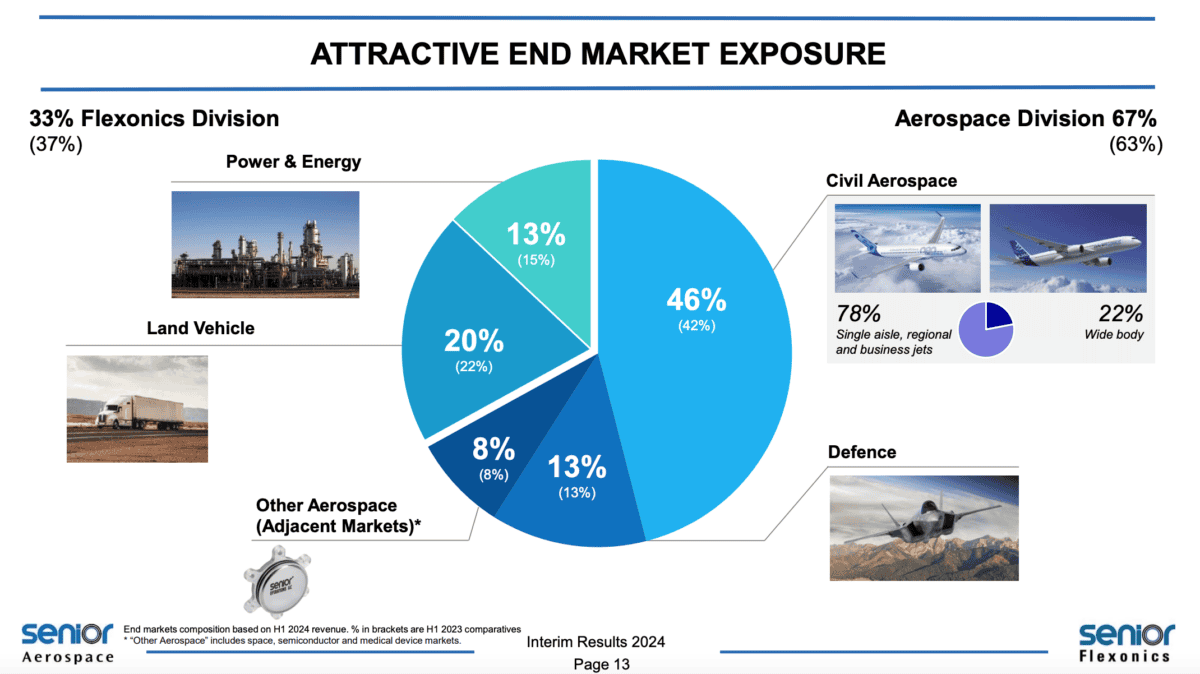

Senior consists of 26 businesses that design and manufacture components. It has two main divisions – Aerospace (both commercial and defence) and Flexonics (land vehicles and energy).

Should you invest £1,000 in Senior Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Senior Plc made the list?

Source: Senior Interim Results Presentation 2024

The company’s products are technical, complex and often built to meet specific customer requirements. And this makes it attractive to investors for two reasons.

First, the business is hard to disrupt. Aircraft components are often subject to regulatory approval, meaning Senior’s customers can’t easily change to another supplier.

Second – and related – this gives the company a degree of pricing power. This should help protect it against the effects of inflation.

Why is the stock down?

Senior’s latest trading update was disappointing for investors. Overall sales increased by 5%, but there were issues in both of the company’s major trading divisions.

While Aerospace revenues grew 13% compared to the third quarter of 2023, this was below the 14% growth achieved earlier this year.

Management highlighted issues in the commercial side of the Aerospace division, which makes up around 46% of group sales. Both Boeing and Airbus have been dealing with output issues.

Flexonics revenues had been down 6% during the first half of 2024. But this increased to a 9% decline, due to reduced truck production in the US and Europe.

Outlook

Senior is clearly in something of a cyclical downturn, but the big question for investors is how long this will last. And management offered a positive outlook on this:

The short-term issues described in this trading update are clearly temporary in nature… Increasing aircraft build rates, operational efficiency benefits and improved price agreements are expected to drive good growth in Aerospace Division performance beyond 2024, and we remain confident of continuing to out-perform the key end markets in which our Flexonics Division operates.

If this is correct, Senior is a good business having a bad year. And that’s the sort of thing that I think long-term investors should pay attention to.

At a price-to-earnings (P/E) ratio of 18, the stock is roughly in line with its 10-year average. But that can sometimes be misleading when it comes to cyclical stocks.

The price-to-book (P/B) multiple can be a better metric for valuing this type of company. And at 1.15, it’s at some of its lowest levels in the last decade outside of the pandemic years.

Senior P/B ratio 2014-24

Created at TradingView

A buying opportunity for me?

Senior is vulnerable to cyclicality in the end markets it sells into. That means there will be good years and bad years and there’s not much the company or its shareholders can do about that.

Despite this, the FTSE 250 manufacturer looks like a genuinely differentiated business dealing with some short-term issues. On that basis, I’m adding it to my list of stocks to consider buying.